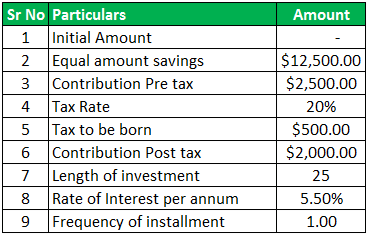

Pre tax contribution calculator

Pre-tax Calculator A 457 plan contribution can be an effective retirement tool. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

Different Types Of Payroll Deductions Gusto

The purpose of the Retirement Contribution Effects on Your Paycheck is to illustrate how increasing contribution amounts to 401 ks 403 bs andor.

. On the other hand to make a 6000 Roth IRA. When you make a pre-tax contribution to your. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

By making pre-tax contributions you are lowering your current taxable income. For example consider an employee that earns 75000 gross income in a given tax year. In general contributions to retirement accounts can be made pre-tax as in a 401k or a traditional IRA.

If his effective tax rate is 24 his tax liability for the year will be 024 x 75000. The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis. Step 2 Figure out the rate of interest that would be earned.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Ad 100s of Top Rated Local Professionals Waiting to Help You Today. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

New Look At Your Financial Strategy. Visit The Official Edward Jones Site. Visit the Social Security please visit the Social Security Calculator smaller taxable income by the Internal Service.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Pre-tax vs post-tax contributions calculator Look at the impact pre-tax or post-tax contributions can make to your super and how they may change your take home pay. Contributions to a traditional IRA qualify for a tax deduction for the year the.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Discover Helpful Information And Resources On Taxes From AARP.

Limit helps reduce your tax liability are. If you are age 50 or over. Our Salary sacrifice calculator helps you to compare the effect on take home pay and super contributions by making additional super contributions using two different methods ie as a.

Thats where our paycheck calculator comes in. For example if you earn 10000 per month and contribute 10 of it towards a 401k retirement savings. S are two of the most popular.

For example a 6000 contribution to a pre-tax retirement plan is an untaxed contribution and therefore its tax- deductible. Also a fixed periodical amount will be invested in the 401 k Contribution which would be a maximum of 19000 per year. The annual maximum for 2022 is 20500.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

For some investors this could prove to be a better option than the Traditional 401 k contributions where deposits are made on a pre-tax basis but are subject to taxes when the money is. Division 293 tax for high-income earners. Division 293 tax is an additional tax on super contributions if your combined income and super contributions are more than the threshold.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

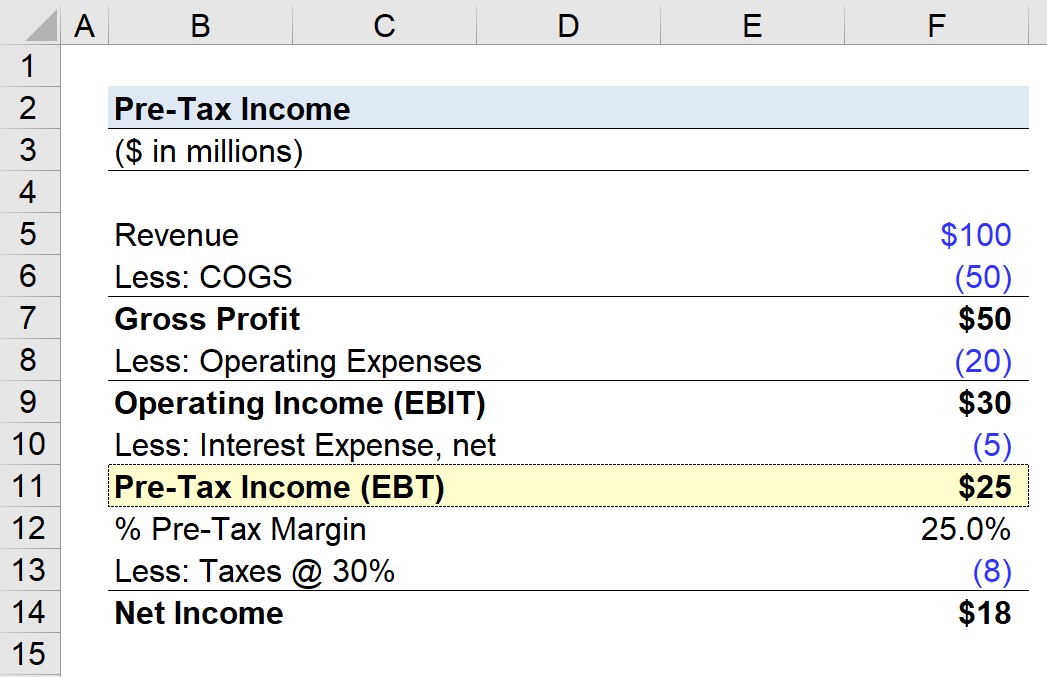

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

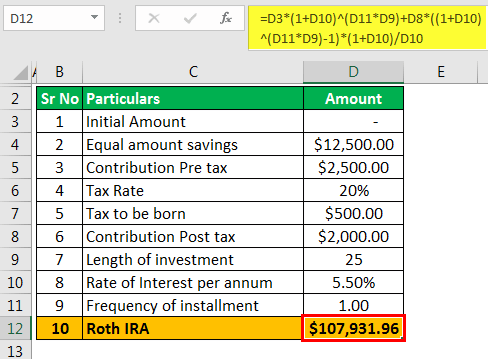

Roth Ira Calculator Roth Ira Contribution

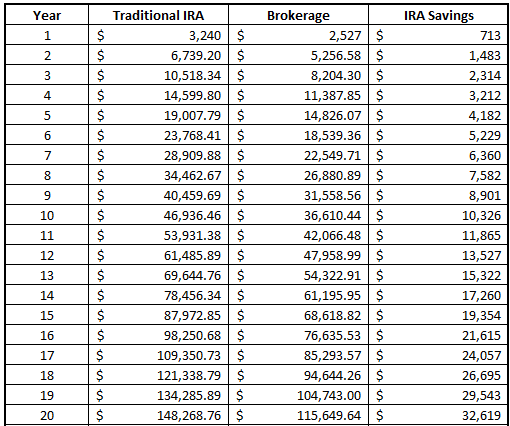

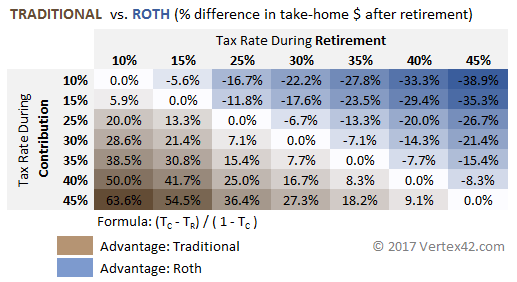

Traditional Vs Roth Ira Calculator

Paycheck Calculator Take Home Pay Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

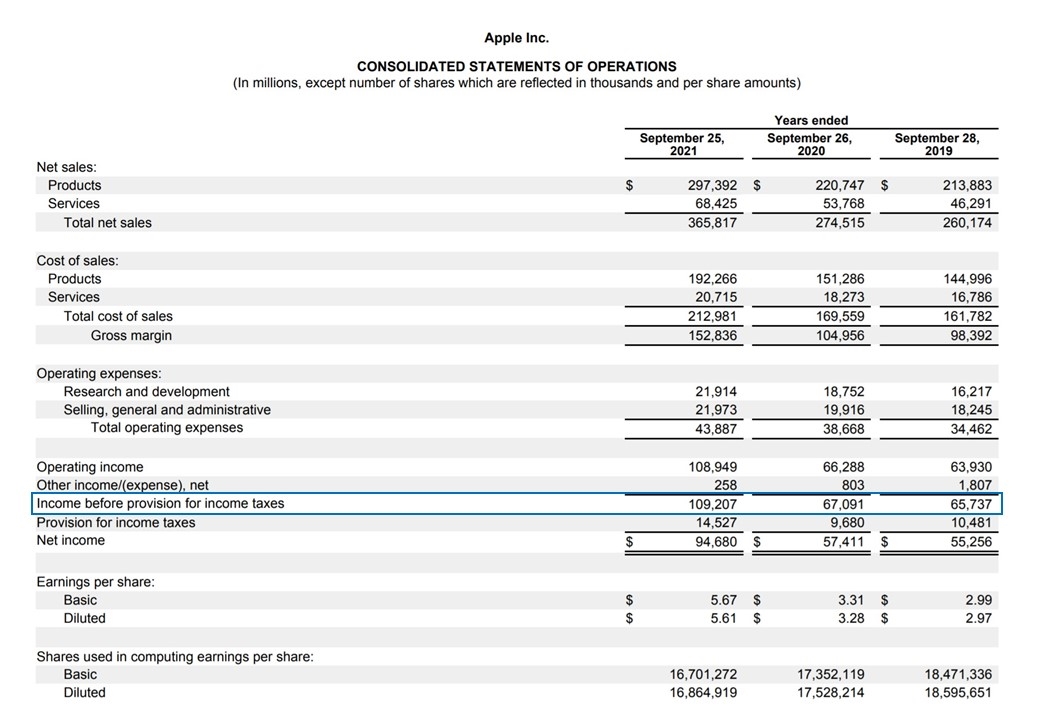

Pre Tax Income Ebt Formula And Calculator Excel Template

Solo 401k Contribution Limits And Types

Traditional Vs Roth Ira Calculator

Pre Tax Income Ebt Formula And Calculator Excel Template

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Paycheck Calculator Take Home Pay Calculator

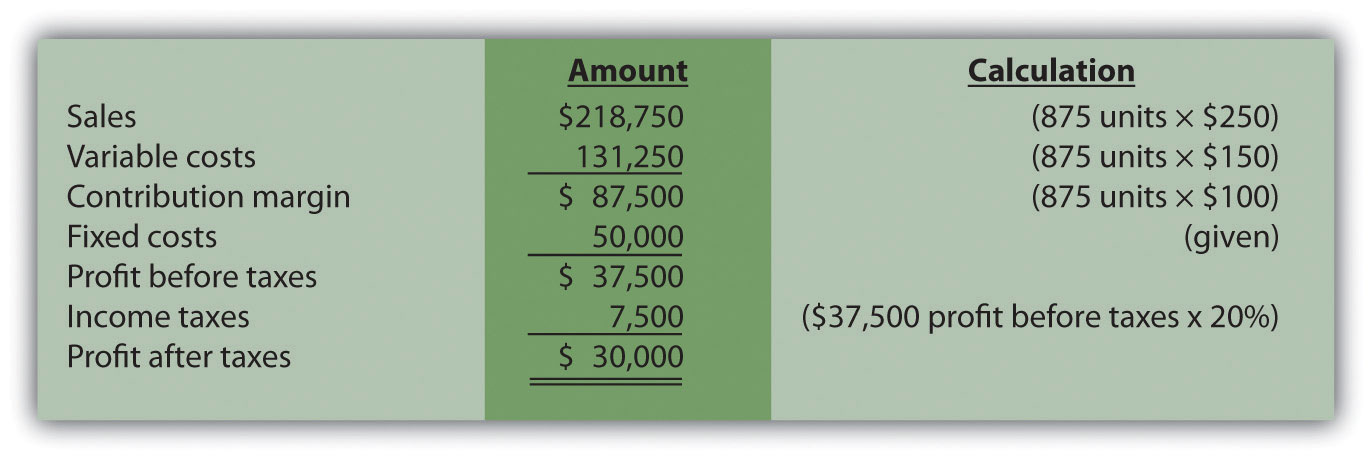

Income Taxes And Cost Volume Profit Analysis

After Tax Contributions 2021 Blakely Walters